By Allan Co, Kenny Lee, Emily Lehman, Sylvia Morse, Nasra Nimaga, Marcelle Pena, Sarah Solon, Eli Tedesco

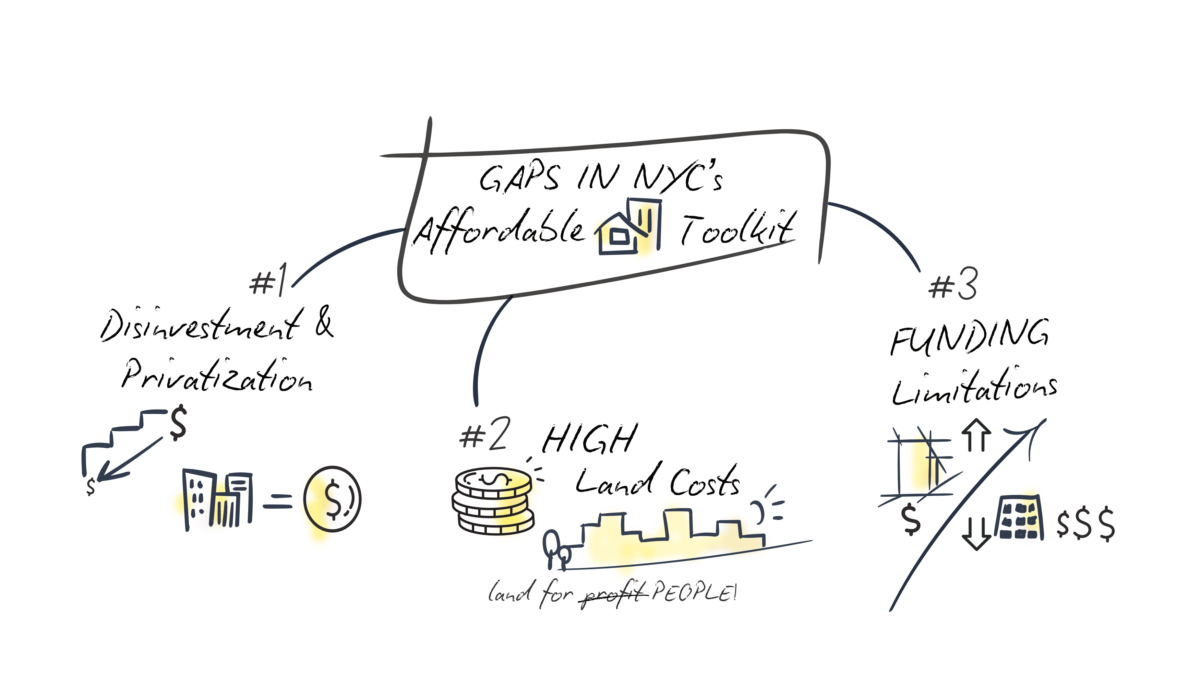

Housing in New York City is defined by scarcity, punishingly high costs, and a lack of long-term planning. A successful housing system would sustain affordability for generations by building and maintaining housing outside the for-profit market. Global cities provide models of scaling non-speculative housing through collective ownership, land cost regulations, and self-sustaining financing that are adaptable to New York City. These models can address three gaps in New York City’s current affordable housing toolkit: disinvestment in the cooperative, nonprofit, and government housing sectors; high land values that inflate housing costs; and lack of housing finance models that are insulated from market fluctuations.

Lessons from Uruguay, Ireland, and Denmark

Collective Ownership and Low-Income Tenant Power: Montevideo, Uruguay

Uruguay has approximately 2,000 housing cooperatives, most of which use the ayuda mutua (“mutual aid”) model. Working-class residents maintain collective ownership of land and housing, made affordable by resident-members contributing labor to housing construction and maintenance. A 1968 housing law established public policy tools and investments for cooperative housing development, including committing public land to cooperatives; providing low-interest (2%), partially-forgivable loans, provided by a public bank; and technical assistance, including architectural and planning expertise, at affordable rates.

Regulatory Solutions to Runaway Property Costs: Ireland

Ireland has struggled with rising land and housing costs for decades. An ambitious national housing plan from 2021, Housing for All, proposed tactics including a Compulsory Purchase Order (CPOs) program for vacant properties; increasing state-owned land availability; implementing new taxes to activate vacant land for residential development; and a Land Value Sharing (LVS) system to recapture land value increases for public benefit.

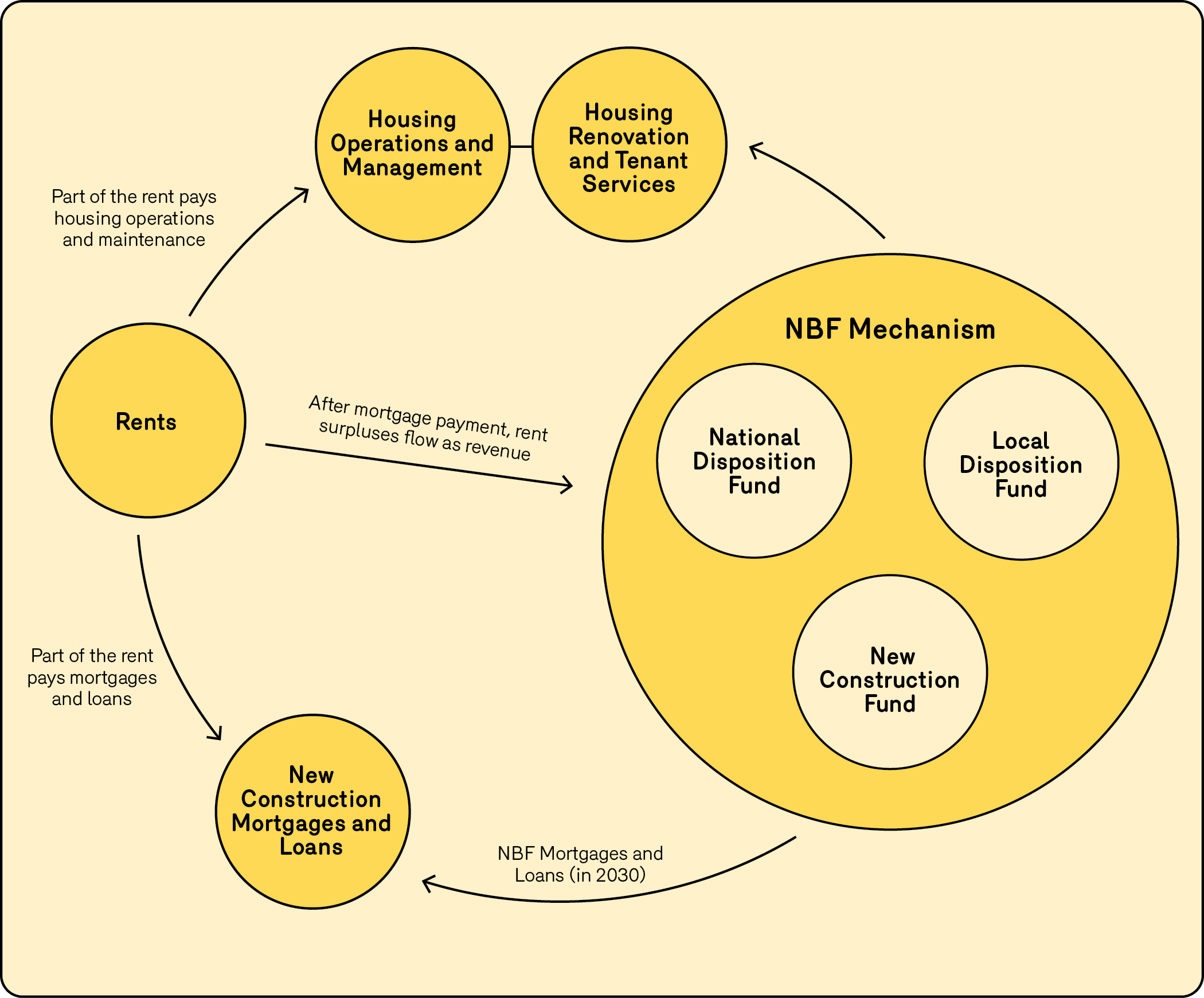

Sustainable Capital and Reinvestment through Sealed-Circuit Financing: Denmark

The National Building Fund (NBF), or Landsbyggefonden (LBF), is a financing mechanism for nonprofit housing in Denmark. Also known as “common” or “general” housing, units are distributed via a waitlist to anyone over the age of 15, regardless of income. NBF was founded in 1967 by parties from across the Danish political spectrum as an independent institution outside the tax system and operates as a “sealed circuit of financing” to protect affordable housing “from fluctuations in finance availability from governments and financial markets.” Financed by tenant rents and regulated by legislation, the NBF supports the construction, renovation, and management of nonprofit housing – operating under the principle that housing within the system is free of speculation and rent is cost-related. Longevity-focused financing and regulation has created a system that after 58 years, is almost fully self-funded and will be able to lend mortgages directly.

Big Swings for New York City

- Invest in tenant-led, permanently affordable housing by legislating commitments of public land, including establishing equitable land acquisition and disposition plans and a land bank; low-interest loans, including by creating a public bank; and ramping up funding for technical assistance. This aligns with policies being advocated for in New York City’s Community Land Trust movement, including the Community Land Act.

- Enact new land value capture policies by returning land to public and/or nonprofit ownership, requiring private landowners to share sales profits with the government through a “flip tax,” requiring higher and deeper levels of permanently affordable housing, and levying a non-activation tax for property owners who hold land that can be developed as housing.

- Create longevity financing through new shared housing finance mechanisms outside of the tax system to sustain the long-term investment, new construction, operations, and affordability of housing, like Denmark’s National Building Fund. A New York City sealed circuit model should apply to the speculative housing sector, so that private landlords not providing affordable units contribute to an affordable housing reserve.

Fellows

Allan Co

Kenny Lee

Emily Lehman

Sylvia Morse

Nasra Nimaga

Marcelle Pena

Sarah Solon