The Urban Design Forum’s 2020 Forefront Fellowship, Cooperative Works, explored how to support minority-owned businesses and workers of color, expand worker cooperatives, and democratize economic resources to build a more inclusive economy. In partnership with the Deputy Mayor for Strategic Policy Initiatives and the Mayor’s Office of M/WBE, Fellows investigated how to create economic opportunity for MWBEs and employee-owned businesses through climate investment, leveraging Local Law 97.

This spring, Fellows developed original projects that explore how to build local power through composting, develop innovative financing for green cooperatives, and scale green entrepreneurship. Explore all proposals here.

by Ricardo Carrillo, Jen Grosso, Jonathan Lane, Tiera Mack, Cara Michell, Kate Selden, Addison Vawters, Annie White

For low-income communities and BIPOC residents who already faced disproportionate environmental, public health and economic challenges, the impacts of the COVID-19 pandemic often expanded these crippling disparities. As NYC pursues economic recovery, it must do so in a way that advances both climate justice and economic democracy for its most disenfranchised residents and workers.

Cooperative worker ownership is a critical tool to empower BIPOC workers by democratizing economic resources. However, this pathway towards closing the racial wealth gap and reducing the corresponding environmental and health disparities is not being pursued widely.

Our team coalesced around tackling barriers to coop growth. After extensive stakeholder outreach, we identified finance as a foundational burden for coop creation and expansion among BIPOC businesses.

While these businesses should be poised to secure a significant percentage of imminent “green jobs,” such as retrofit contracts through Local Law 97, the lack of accessible capital has created an unequal and exclusive market for cooperatives to compete. Planners, architects, and policymakers can accelerate new ways of thinking around equitable and non-extractive financial products for new and emerging BIPOC-majority cooperatives. Our perspective as non-experts and Forefront Fellows affords us the unique position to:

- Demystify both cooperatives and finance to understand why they have not traditionally mixed, through educational tools,

- Connect mission-aligned capital providers and cooperatives to co-create financial products, specific to the needs of coops, through our proposal: The Cooperative Business Roundtable.

These demystifying educational tools, as well as facilitation tools and other resources related to The Cooperative Business Roundtable are available in full at coopfinance.nyc.

Demystifying Cooperative Finance

The primary engine of our economy, capital, is relatively ignorant of the cooperative movement and the benefits of the cooperative firm model — as is finance, by extension. Due to this knowledge gap and existing legal constraints, financial providers offer very few products to support worker cooperatives. Further, many coop advocates and potential worker owners, who have deep knowledge of the coop and worker experience, are not as fluent in the language of traditional financing. Our team, relying on the expertise and guidance of those working in the coop field, have compiled resources and tools that can be widely shared for public education: “Demystifying Employee Ownership” and “Demystifying Finance.”

The Cooperative Business Roundtable

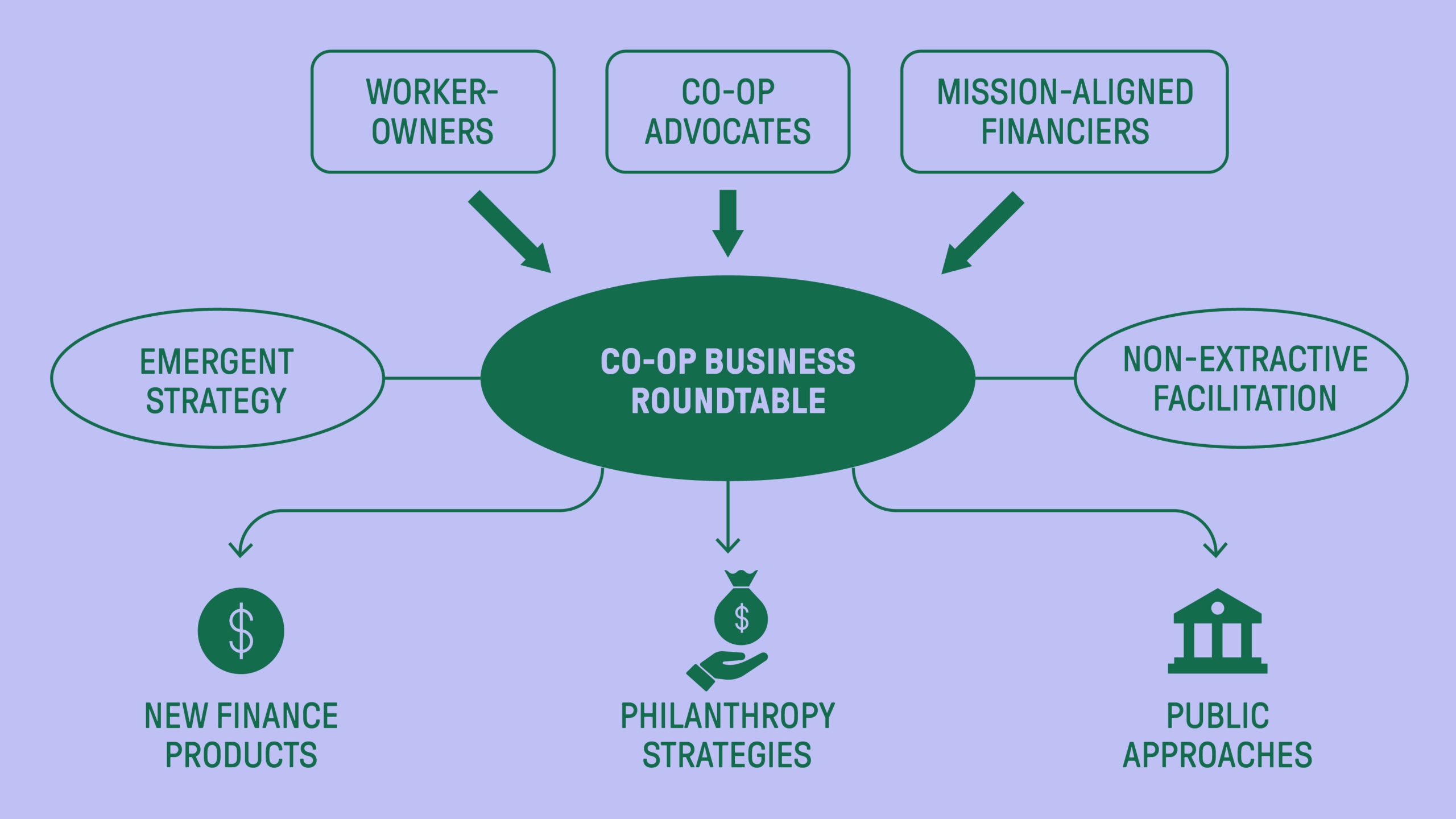

The City of New York, in partnership with mission aligned financing partners and the Urban Design Forum, can leverage their convening power to learn from and center workers of color as economic co-creators. The Forefront Fellows have gathered and developed a series of tools to guide municipal leaders through facilitating Cooperative Business Roundtable gatherings.

The Cooperative Business Roundtable brings together critical experts in an action-driven forum to generate new ideas for financial tools, products, and supports, in order to achieve the following goals:

- Close the racial wealth gap by democratizing business ownership and worker ownership.

- Promote financial innovations to generate non- or least-extractive financial products and solutions that directly address capital providers’ missions and potential coop needs.

- Generate connections between ecosystem actors, including would-be funders and would-be worker-owned businesses, traditional and nontraditional capital providers, and mission-aligned public, private, and nonprofit actors.

Facilitating a roundtable to engage private and nonprofit stakeholders already active in this work helps reinforce, rather than duplicate, existing efforts; while centering cooperative business participants ensures they play a central role in co-creating potential products and are connected to those resources once deployed. If formatted, facilitated, and structured in a way that is idea-generative, oriented toward tangible action, and that compensates beneficiaries for their participation, such a convening can also strengthen stakeholder connections, build ideological alignment, and avoid extractive, unfunded thought labor from the entities most in need of support.

Through Demystifying Cooperative Finance and the Cooperative Business Roundtable, we can pursue wider understanding of the needs of cooperative businesses and create a new forum for New York City where financial products, philanthropic grant strategies, or even public financial institutions can be transparently and collaboratively built. Collectively, these innovative solutions will increase the size, number, and competitiveness of BIPOC-majority cooperatives, and will help drive greater economic and worker democracy into one of the world’s largest urban economies.