Since the federal government withdrew direct subsidies for affordable housing development about three decades ago, the City of New York has relied on three main vehicles to preserve or develop affordable housing: low-cost land, grants and low-interest loans, and tax abatements and exemptions. The City has successfully streamlined the delivery system for land sales and making grants and loans. But tax abatements and exemptions remain tangled.

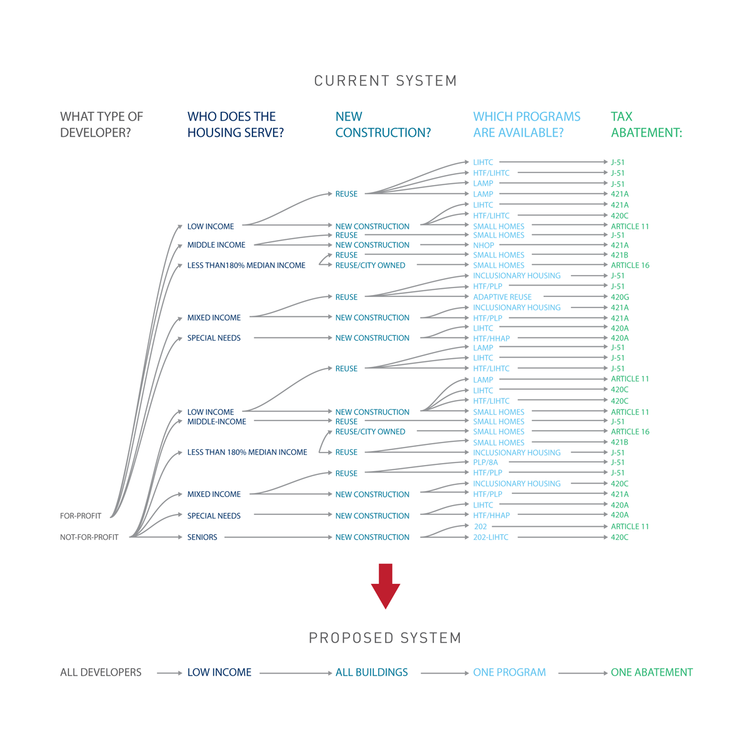

The City of New York has claimed, in a number of different venues, that they are exploring permanent affordability programs for housing, yet there is no tax abatement program that provides benefits to owners of that housing in perpetuity. Currently, there exists an array of programs with different terms and recipients. The housing finance program, for-profit or not-for-profit status of the developer, and whether a project is new construction or rehab lead each project down a different path. The process is taxing and does exactly the opposite of what it should do — it drives development costs up.

The City should create one tax abatement and exemption program for affordable housing. If our primary goal is to create more low- and moderate-income housing that lasts, we can do that better with one simplified program. The term of that tax abatement should be equal to the length of the regulatory agreement that it complements. The additional cost to the City should be nil.

Kathleen Dunn is a Principal at Dunn Consulting and Development where her work has focused on affordable housing development and urban planning. Ms. Dunn is also Adjunct Assistant Professor at the NYU Wagner School of Public Policy.

Image: Urban Design Forum.